>>> Join us to access robo analyses for over 16,000+ stocks! <<<

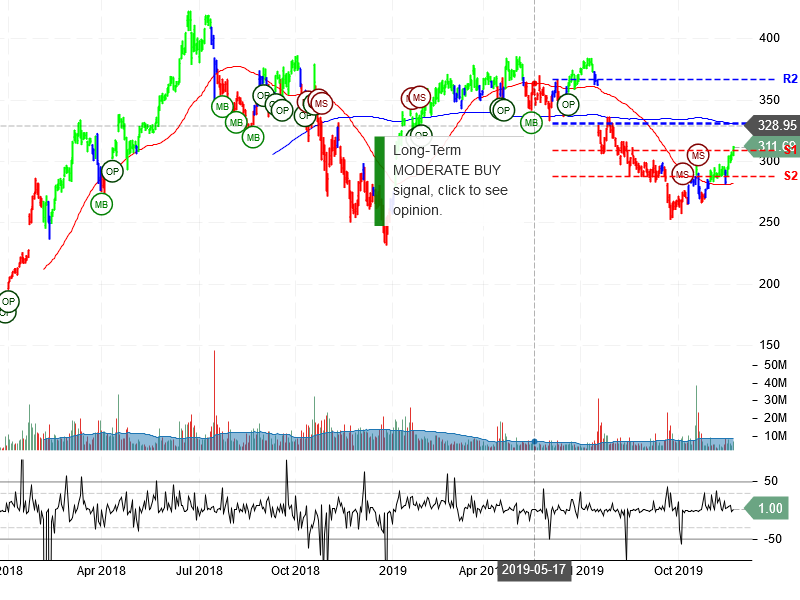

Netflix Inc (NFLX) “On a long-term technical basis, the stock (NFLX) is trading below its 200-day moving average which implies it is in a negative trend.

The stock has support at 308.75 and 288.00. If the stock breaks down through support at 308.75 then it will probably continue lower to 288.00. The stock has resistance at 330.73 and 367.10. If the stock breaks up through resistance at 330.73 then it will probably continue higher to 367.10. The 200-day moving average is at 330.73. This will also act as resistance. The stock’s long-term uptrend has changed into a sideways or downtrend. In this case, the stock will either go sideways for a while or sell-off back to where it started prior to the latest big upmove. This is a risky time for the stock, so be careful. Use caution during times like these, as the stock will be more volatile. Pay close attention to the Short-Term and Daily Opinion. The stock is extremely overbought according to the Stochastic Indicator (85.90).”

>>> Join us to access robo analyses for over 16,000+ stocks! <<<