>>> Join us to access robo analyses for over 16,000+ stocks! <<<

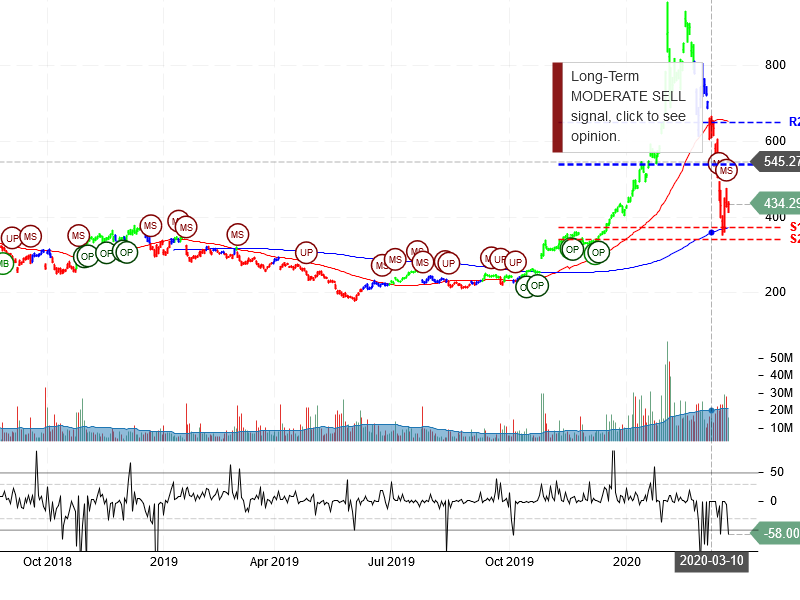

Tesla Inc (TSLA) “On a long-term technical basis, the stock (TSLA) is trading above its 200-day moving average, but has broken through an important support level, which implies it is in a neutral trend.

The stock has support at 371.60 and 340.84. If the stock breaks down through support at 371.60 then it will probably continue lower to 340.84. The stock has resistance at 538.61 and 650.32. If the stock breaks up through resistance at 538.61 then it will probably continue higher to 650.32. The 200-day moving average is at 371.60. This will also act as support. The stock’s long-term uptrend has changed into a sideways or downtrend. In this case, the stock will either go sideways for a while or sell-off back to where it started prior to the latest big upmove. This is a risky time for the stock, so be careful. Use caution during times like these, as the stock will be more volatile. Pay close attention to the Short-Term and Daily Opinion. The stock is extremely oversold according to the Stochastic Indicator (11.71), so look for a possible rebound soon. Confirm this with the Short-Term Opinion and Daily Opinion to keep from exiting prematurely.”

>>> Join us to access robo analyses for over 16,000+ stocks! <<<