>>> Join us to access robo analyses for over 16,000+ stocks! <<<

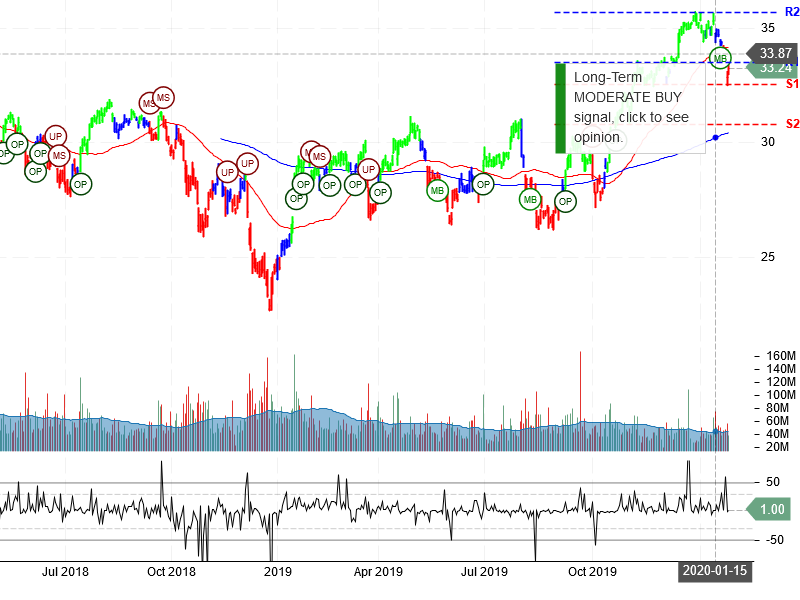

Bank of America Corporation (BAC) “On a long-term technical basis, the stock (BAC) is trading above its 200-day moving average which implies it is in a positive trend. However, the stock has recently broken through an important trendline at 33.49 suggesting the next support level is at 32.55. This weakness suggests the long-term trend is turning neutral.

The stock has support at 32.55 and 30.82. If the stock breaks down through support at 32.55 then it will probably continue lower to 30.82. The stock will meet resistance at 33.49 and 35.67. If the stock breaks up through resistance at 33.49 then it will probably continue higher to 35.67. The 200-day moving average is at 30.43. This will also act as support. The stock is extremely oversold according to the Stochastic Indicator (17.77).”

>>> Join us to access robo analyses for over 16,000+ stocks! <<<