>>> Join us to access robo analyses for over 16,000+ stocks! <<<

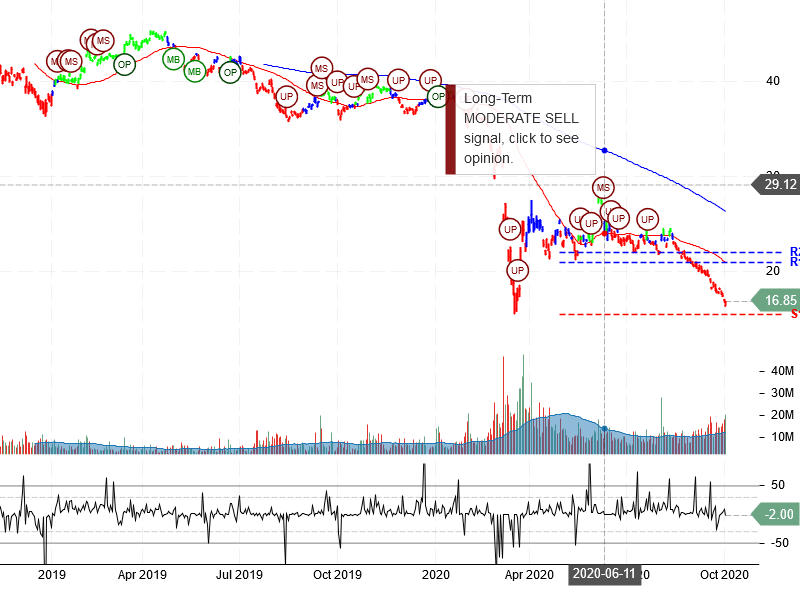

BP p.l.c (BP) “On a long-term technical basis, the stock (BP) is trading below its 200-day moving average which generally implies it is in a negative trend.

The stock has support at 15.51 and 11.89. If the stock breaks down through support at 15.51 then it will probably continue lower to 11.89. The stock has resistance at 20.96 and at 22.03. If the stock breaks up through resistance at 20.96 then it will probably continue higher to 22.03. The 200-day moving average is at 26.38. This will also act as resistance. However, the stock has broken out of its long-term downtrend according to the fibonacci fan, which is significant. If the stock can form new support above 15.51 look for a rally to previous highs. The stock is extremely oversold according to the Stochastic Indicator (5.92).”

>>> Join us to access robo analyses for over 16,000+ stocks! <<<