>>> Join us to access robo analyses for over 16,000+ stocks! <<<

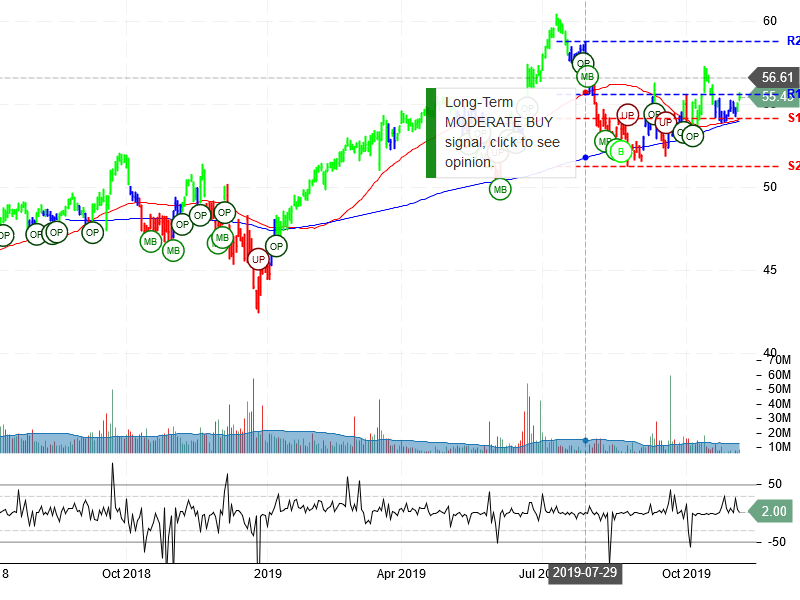

Oracle Corporation (ORCL) “On a long-term technical basis, the stock (ORCL) is trading above its 200-day moving average which implies it is in a positive trend. However, the stock has broken through an important trendline at 57.03 suggesting the next level of support is 54.14. The long-term uptrend has now turned neutral.

The stock has support at 54.14 and 51.25. If the stock breaks down through support at 54.14 then it will probably continue lower to 51.25. The stock will meet resistance at 55.64 and 58.79. If the stock breaks up through resistance at 55.64 then it will probably continue higher to 58.79. The 200-day moving average is at 54.01. This will also act as support. If the stock closes below 53.58 a negative trend change is probable. Look for the stock to fall to the level where it started prior to the latest big upmove. The stock is slightly oversold according to the Stochastic Indicator (33.22).”

>>> Join us to access robo analyses for over 16,000+ stocks! <<<